After standing by as House Republicans passed President Donald Trump’s “big, beautiful bill,” the Senate is taking center stage in the debate over the GOP’s priorities that could stretch well into July.

GOP senators are pledging to rewrite the legislation, which currently includes tax and spending cuts, raises the debt ceiling, and boosts funding for border security and defense. Although Republicans have set a July 4 deadline for both chambers to approve the bill, lawmakers remain weeks away from finalizing a version that can clear both the House and Senate.

Clearing the bill through the Senate will be an uphill battle. With no Democratic support expected, Senate Majority Leader John Thune (R-SD) can afford to lose only three Republican votes, but more than that number have already raised serious objections to the current legislation.

Though the final legislation will likely mirror broad elements of the deal brokered by Speaker Mike Johnson (R-LA), GOP senators are hammering out differences over deeper budget cuts, Medicaid provisions, clean energy incentives, and more.

Here are the eight ways Republican senators are split on the current version of the bill.

1. Medicaid provisions

The House bill would impose strict new rules to maintain eligibility for Medicaid, which would require adult recipients to document at least 80 hours per month of employment or approved volunteer activities, with narrow exemptions that would include pregnant women.

The rule would kick in at the end of 2026 and other rules would involve frequent eligibility checks, every six months instead of annually, as well as verification of residency and legal immigration status.

According to the nonpartisan Congressional Budget Office, the legislation would reduce Medicaid spending by roughly $700 billion compared to the existing policy and result in approximately 8.6 million people losing health insurance. The projection assumed work requirements would start in 2029, but the updated version implements the requirement sooner, so the number of people without coverage could be higher.

Sen. Susan Collins (R-ME) has concerns about Medicaid recipients who are unable to work and rural hospitals.

“The one thing that I would support are carefully crafted work requirements for able bodied adults without preschool children,” Collins said, speaking to reporters earlier in the month. “I want to make sure we are not depriving seniors, children, low-income families, people with disabilities, and our rural hospitals.”

Sen. Josh Hawley (R-MO), a populist conservative, has vowed to oppose the bill if it cuts Medicaid benefits and is taking issue with changes to a provider tax that helps states finance Medicaid programs. Missouri currently has comparatively low provider taxes, which puts the state at a competitive disadvantage.

“If you fool around with that provider tax in my state, you really risk getting to benefit cuts there,” Hawley said.

Sen. Lisa Murkowski (R-AK) expressed concern that her state may face challenges implementing the proposed work requirements due to its aging Medicaid payment infrastructure.

“There are some things that we want to address on the Medicaid side that I think are challenging for us in Alaska,” Murkowski said.

2. Clean energy tax breaks

The House proposal would eliminate incentives for wind, solar, and geothermal projects established by Democrats in 2022, unless developers break ground within two months of the legislation’s enactment.

The change is dividing Republicans, given that many red states benefit from the incentives. Sens. Murkowski, Thom Tillis (R-NC), John Curtis (R-UT), and Jerry Moran (R-KS) raised concerns about the change in a letter to Thune last month.

Tillis has indicated he would advocate for a slower, more incremental phaseout to prevent catching businesses off guard.

“I think that even if we’re going to revise them, we’ve got to make sure that businesses who believe the government was setting this as a priority don’t have a lot of stranded costs,” Tillis told reporters.

3. Spending

Although certain GOP senators have reservations about the level of spending reductions in the House plan, the fiscal hawks of the Senate are advocating even deeper cuts.

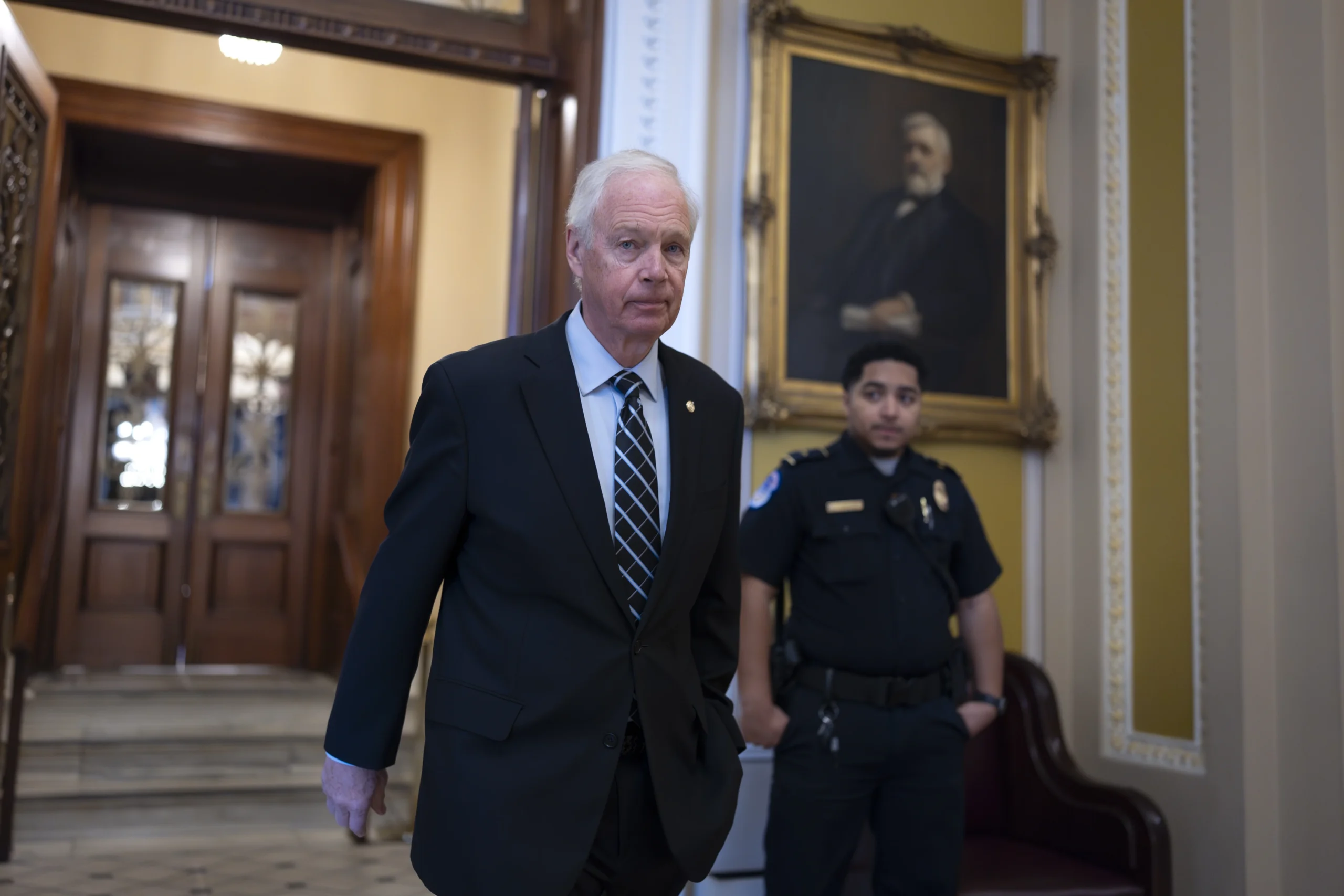

To make up for the decline in tax income, House Republicans pushed at least $1 trillion in cuts targeting Medicaid, food assistance, and reductions in green energy initiatives. However, Sen. Ron Johnson (R-WI), a leading fiscal conservative, said the bill doesn’t go far enough.

“It should be D-O-A. We shouldn’t even be talking about this bill,” Johnson told the Washington Examiner. “It’s so awful. It’s so far off the mark. It’s so inadequate. I’ve been trying to interject reality. I’ve been trying to interject facts and figures.”

An analysis from the Congressional Budget Office projected the House bill would add some $3 trillion over the next decade to the national debt, which already stands at $36 trillion.

Johnson warned that the legislation could be derailed unless Republicans align with his push for deeper spending cuts, including the creation of a bicameral effort to go “line by line” in identifying approximately $6.5 trillion in reductions over the next 10 years.

The Wisconsin senator said at least three other senators are aligned with him.

4. The state and local tax deduction

Several House Republicans representing high-tax states withheld their support for the bill unless it included provisions to let their constituents claim larger deductions for state and local taxes on their federal tax returns.

Senate Republicans appear to be split on whether to uphold the deal Speaker Johnson struck with House Republicans from New York, New Jersey, and California to increase the limit on state and local tax deductions from $10,000 to $40,000. Some are pushing to remove the SALT provision entirely.

“I don’t know why we’d give a huge tax cut to rich people who live in California, New Jersey, and New York,” Hawley said.

Other GOP senators want to keep Speaker Johnson’s deal on SALT with the House as is because they’re worried changing it might hurt the bill’s chances of passing the House again after the Senate makes its tweaks.

5. Permanent tax cuts

Many Republican senators want to make many of the tax cuts permanent, while the House bill has shorter time frames for many of its cuts.

Thune, along with Sen. Mike Crapo (R-ID), who is heavily involved in shaping the bill as Finance Committee chairman, has made it clear they want to ensure several business tax incentives become permanent.

“We believe that permanence is the way to create economic certainty, and thereby attract and incentivize capital investment in this country that creates those good-paying jobs and gets our economy growing and generates more government revenue,” Thune said, speaking to reporters last week.

6. A boosted child tax credit

The House bill would raise the child tax credit temporarily from $2,000 to $2,500 per qualifying child for tax years 2025 through 2028. After 2028, the credit would revert to $2,000, adjusted for inflation.

Several GOP senators including Sen. Katie Britt (R-AL) and Hawley are pushing to make the credit even larger.

Britt wants to see expansions of two child care tax breaks, as she’s pushed a bipartisan measure with Sen. Tim Kaine (D-VA) aimed at enhancing support for child and dependent care.

“This is exactly the kind of pro-family, pro-Main Street, pro-worker legislation that has the ability to both transform our economy and support families,” Britt recently said during a speech on the Senate floor this month.

7. Artificial intelligence

The House bill’s artificial intelligence provision would halt state-level oversight of AI for 10 years, barring enforcement of any existing or forthcoming laws. The section of the bill includes the ban alongside a $500 million funding allocation over that time period aimed at modernizing government operations with AI and automation.

Although the provision received broad support from Republicans during a House subcommittee session on May 21, two prominent GOP senators have recently spoken out against it.

Sen. Marsha Blackburn (R-TN) challenged the ban during a discussion of the No Fakes Act, a bipartisan measure she co-authored aimed at safeguarding artists’ voices, likenesses, and images from unauthorized AI-generated deepfakes.

“We certainly know that in Tennessee, we need those protections,” Blackburn said, discussing Tennessee’s ELVIS Act, a version of her proposal at the local level. “And until we pass something that is federally preemptive, we can’t call for a moratorium.”

Hawley also pushed back against the measure, expressing support for letting states experiment with their own AI regulations while also calling for reasonable federal oversight to safeguard individual freedoms, in an interview with Business Insider.

8. The debt limit

The legislation passed by the House features a $4 trillion boost to the debt limit. Treasury Secretary Scott Bessent has cautioned that the federal government could exhaust its funds and be unable to meet financial obligations by August if lawmakers fail to intervene.

Republicans are working to pass the debt limit increase within the legislation through a party-line vote that would extend borrowing authority beyond the 2026 election, avoiding the need to negotiate terms with Democrats.

Sen. Rand Paul (R-KY) said he won’t support the bill if the debt ceiling increase is included.

“I think if you’re going to raise the debt ceiling $4 or $5 trillion, it indicates that the project afoot isn’t going to fix the deficit at all,” Paul said. “Once Republicans vote for this, Republicans are going to own the deficit.”

GOP TAX BILL WILL CLEAR SENATE 95% INTACT, HOUSE CHAIRMAN PREDICTS

The more amendments senators make to the bill, the harder it will be to secure passage in the House, where Republicans hold a narrow 220-212 edge. Both chambers must pass the exact same version before it can be sent to Trump for approval. Speaker Johnson urged the Senate to minimize alterations to the bill, but Trump himself stated last week that he anticipated the upper chamber would introduce “fairly significant” changes.

Ramsey Touchberry contributed to this report.