The Change Co. seemed like the perfect company for Colin Kaepernick’s SPAC to buy. The California lender focuses on minority borrowers underserved by traditional banks, a snug fit with the former National Football League star’s social-justice activism.

But a deal ran aground last week over a peculiar issue: Mr. Kaepernick’s reluctance to stump for the merger on live television, people familiar with the matter said.

Mr. Kaepernick balked at requests from Change Co. executives that he sit for an appearance with George Stephanopoulos on “Good Morning America” and declined to participate in interviews as part of the rollout, according to an internal document.

The deal is now dead, these people said.

“The Change Company would proudly consider a partnership with Mr. Kaepernick—yesterday, today, or tomorrow,” the lender’s chief executive, Steven Sugarman, said in a written statement on Thursday that praised the former quarterback’s commitment to racial justice.

A spokesman for Mr. Kaepernick’s Mission Advancement Corp. said that the company operates “with the highest ethical standards” and will “continue our work while we look for a great fit to merge with in 2022.”

Special-purpose acquisition companies, or SPACs, are blossoming. There are artificial-intelligence SPACs, green-energy SPACs and even at least two SPACs doing deals with sellers of outdoor cooking equipment. Celebrity SPACs are especially fertile. Shaquille O’Neal, Sammy Hagar, Alex Rodriguez, restaurateur Danny Meyer, and former House Speaker Paul Ryan all have SPACs. The pitch to investors is that their star power, social-media following and financial contacts will help the company succeed.

The high-wattage fundraising is controversial; Securities and Exchange Commission chief Gary Gensler called out celebrity endorsements in a critique of SPAC marketing earlier this month and cautioned against “misleading hype.”

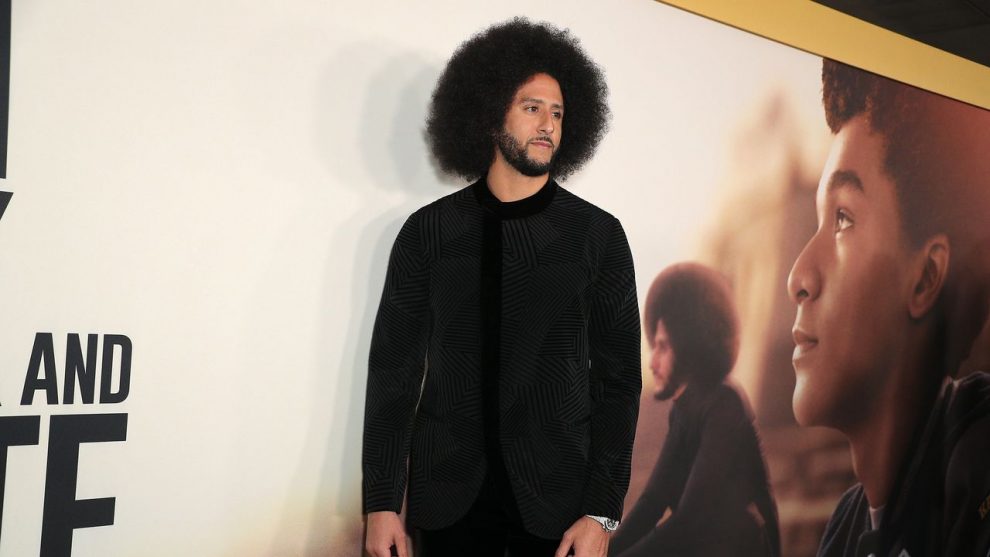

Mission Advancement went public in March and raised $345 million to acquire a company with a socially conscious bent. Mr. Kaepernick, who became a leader of the racial-justice movement since he went unsigned by National Football League teams after kneeling during the national anthem to protest issues such as police brutality, is Mission’s co-chairman along with Jahm Najafi, who runs a private-equity fund and is a minority owner in the National Basketball Association’s Phoenix Suns.

Like all SPACs, Mission searches for a target with which it will merge, effectively taking that company public. By early fall, it had homed in on Change and by mid-December was on the cusp of a deal valuing the lender at about $1.1 billion, according to the people familiar with the matter and investor documents reviewed by The Wall Street Journal.

But the two sides found themselves at odds over whether and how Mr. Kaepernick would tap his celebrity status to promote it. When Change executives tried to schedule a sit-down with “Good Morning America,” where Mr. Kaepernick would likely have been pressed both about the business and on the protests that made him a controversial figure and stymied his NFL career, Mission executives pushed back.

Such an appearance would have been out of character for Mr. Kaepernick, who has never spoken about the issue in such a forum and has granted few interviews. Instead, he has cultivated his image through his social-justice initiatives and scripted appearances, most notably an advertising campaign with Nike Inc. and a six-part documentary about his childhood that ran on Netflix Inc. this fall.

Change is what is known as a community development financial institution, a special regulatory designation for firms that lend to minority groups, rural residents and other communities that have trouble getting access to mainstream banking products. CDFIs receive financial support from the U.S. Treasury and often partner with big commercial banks. Many are nonprofits; Change isn’t.

Change was founded in 2017 and is run by Mr. Sugarman, a former executive at the Banc of California. He left that company in an acrimonious dispute with the board.

Change originated $7 billion in loans in 2020 and booked $113 million in profits, according to documents shown to prospective investors.

When SPACs make an acquisition, they typically also raise new money from private investors, which validates the transaction and gives the company cash to fund its growth.

Mission, Change and their bankers fanned out to more than 100 potential investors, firms that might want a piece of a socially conscious deal or celebrities who might kick in their own fame and money. Mission executives often referred to Mr. Kaepernick as a once-in-a-generation cultural icon; both sides hoped his star power would bring in investors and corporate partners.

Actor Tyler Perry agreed to invest, one of the people familiar with the matter said, and the Atlanta firm that manages his money made a $1 million commitment, the documents show. Mr. Kaepernick’s cachet helped land more investors—WNBA stars Diana Taurasi and Maya Moore, music producer J. Cole, and rappers Quavo and Nas were in, according to the documents. But the commitments weren’t large, and some of the celebrity investors expected to be paid for any promotional efforts.

The sponsor group, Messrs. Kaepernick and Najafi, were set to contribute $10 million. Had the deal been completed, they would have received founder shares in the combined company worth about $80 million, according to the SPAC’s public filings. Mr. Kaepernick and the sponsor group also were going to donate up to one million shares, with a value near $10 million, to down-payment assistance efforts to support Black homeownership.

But big names on Wall Street, including BlackRock Inc., Fidelity Investments and T. Rowe Price Group Inc., which are among the most active SPAC investors, said no, according to the people familiar with the matter and documents reviewed by the Journal. The three declined to comment.

Serena Williams’s venture fund passed, according to those documents. So did Oprah Winfrey’s money manager. Nike and venture firm Andreesen Horowitz, whose co-founder is listed on Mission’s website as an adviser, also looked at the deal and didn’t commit, the documents say.

‘There is a real question about whether there is [a] halo effect that translates into investor dollars. We need to question that assumption.’

— Steve Sugarman, The Change Co. chief executive

The week before Thanksgiving, executives from Mission and Change met with executives from Netflix. The streaming giant had just aired the Kaepernick documentary, and the year earlier it had moved $10 million of its cash holdings to Change as part of a pledge to support small lenders serving Black communities.

By the time the deal fell apart, Netflix hadn’t committed. Netflix declined to comment.

Mission ultimately had commitments for about two-thirds of the $100 million it was targeting, most of it from a pair of real-estate investment firms, Angelo Gordon and MFA Financial Inc., the people familiar with the matter said.

“There is a real question about whether there is [a] halo effect that translates into investor dollars,” Mr. Sugarman wrote in an email this month to Mission executives. “We need to question that assumption.”

Story cited here.