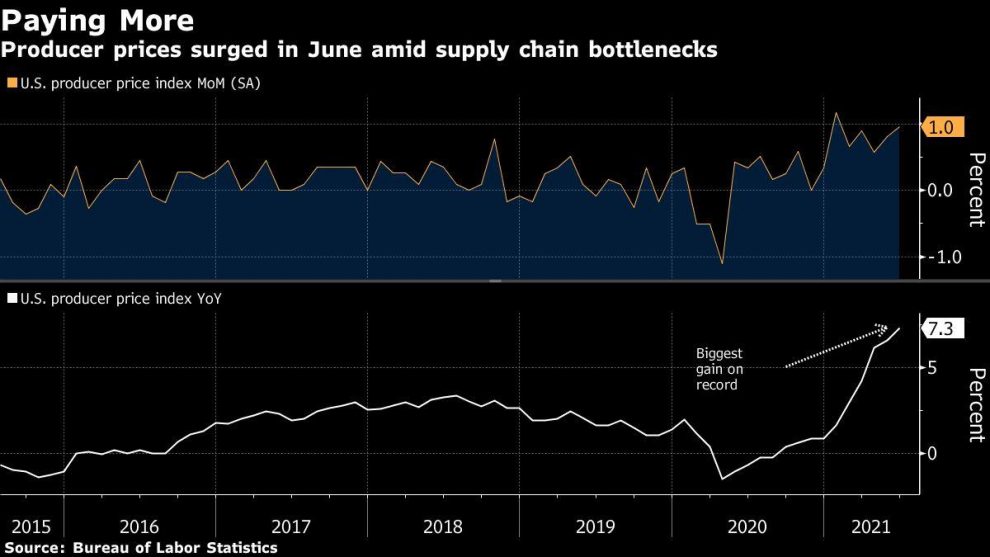

Prices received by U.S. businesses for goods and services rose by much more than expected in June, the Labor Department reported Tuesday.

The Producer Price Index rose 7.3 percent in June from 12 months earlier, the largest demand since 12-month data were first introduced in 2010. Compared with May, the index rose one percent. On average, this index rose by around 0.2 percent per month in the pre-pandemic Trump administration.

Economists had been expecting an increase of 0.6 percent, below the 0.8 percent initially reported for May. On a 12-month basis, the consensus forecast was for 6.8 percent.

Nearly 60 percent of the June advance in the index can be traced to a 0.8-percent increase in prices for final demand services. The index for final demand goods moved up 1.2

percent. Seventy percent of PPI’s gain is attributable to margins for trade services, which moved up 2.1 percent. (Trade services measure changes in margins received by wholesalers and retailers rather than changes in prices.)

Twenty percent of the June increase in the services index can be traced to margins for automobiles and automobile parts retailing, which rose 10.5 percent.

Prices for gasoline, meats, electric power, processed poultry, and motor vehicles all moved higher in June. Prices of industrial chemicals jumped 4.5 percent in the month. Sporting and athletic goods jumped 3 percent for the month.

Core PPI inflation—which excludes foods, energy, and a measure of sales margins called trade services—rose 0.5 percent in June following an increase of 0.7 percent in May. On an annual basis, core PPI inflation moved up 5.5 percent, the largest advance since 12-month data were first calculated in August 2014.

The Producer Price Index is an alternative gauge of inflation. It actually predates the better-known Consumer Price Index. First published in 1902, it is the oldest continuous statistical series of the U.S. government. The index used to be known as the Wholesale Price Index, a somewhat misleading name since it was never focused on wholesale prices. Because of changes in what gets counted, however, the headline “final demand” PPI data only dates back to around 2010 after a 2014 overhaul meant to update the index to better reflect the modern economy.

The two indexes track a somewhat different basket of goods and services and do so from different economic perspectives. Where CPI measures prices paid by consumers, the Producer Price Index measures prices from the perspective of sellers. Where CPI includes imports but excludes exports, PPI includes exports but excludes imports. PPI also covers government purchases that do not get counted in CPI. PPI only covers around 72 percent of the services sector, notably excluding residential rents and education that are included in CPI.

Over time, the two tend to track each other—although they can diverge in any particular period. Both are showing much higher levels of inflation than have been seen in years.

Story cited here.