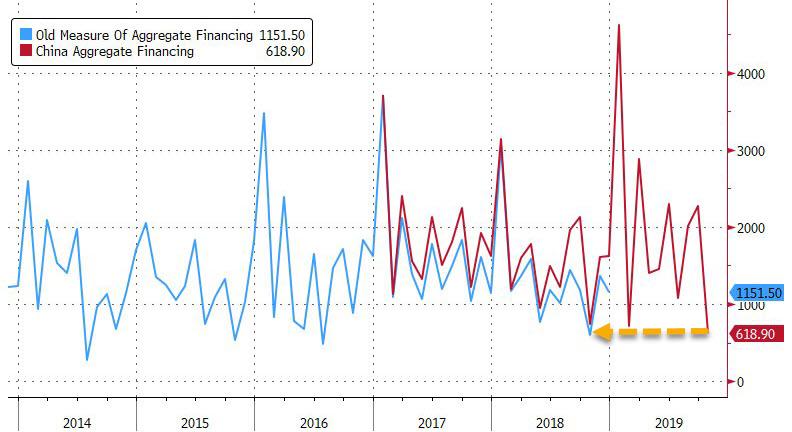

While it will hardly come as a surprise to anyone following China’s dismal attempts at reflating the economy, which on Monday we learned translated into the lowest Aggregate Financing print since the series was established…

Christian university rebranding DEI to evade Trump order, enroll illegals, Tennessee rep says

Mike Huckabee Threatens to Declare Israel ‘No Longer Welcoming’ to Christian Organizations After ‘Shocking’ Policy Change

Former Voice of America Staffer Charged Over Alleged Death Threats Against Marjorie Taylor Greene

NIH still blaming FOIA delays on the pandemic

New York settles Andrew Cuomo sexual harassment case for nearly $500,000

Americans detained in Venezuela freed and returning home after prisoner exchange

Trump sues Wall Street Journal for libel after Epstein birthday letter story

Trump vows to make US ‘crypto capital of the planet,’ signs GENIUS Act into law

Illegal pleads guilty to impregnating his own daughter at blue state migrant shelter

Watch: Rare ‘Firenado’ Captured on Video as it Cuts a Swath of Destruction

FBI captures final illegal immigrant inmate who escaped ICE facility in New Jersey

Illegal Alien Claimed She Was Illegally Kidnapped by ICE – Then the Surveillance Footage Was Located

Germany admits Europeans were ‘free riders’ on defense and national security

Border Patrol Hits Jackpot in Raid on California Home Depot

Missing mom’s convicted killer claims boyfriend tainted his trial

Source: Bloomberg

… reaffirming Beijing’s impotence at stimulating the all-important credit impulse which is barely above cycle lows…

Christian university rebranding DEI to evade Trump order, enroll illegals, Tennessee rep says

Mike Huckabee Threatens to Declare Israel ‘No Longer Welcoming’ to Christian Organizations After ‘Shocking’ Policy Change

Former Voice of America Staffer Charged Over Alleged Death Threats Against Marjorie Taylor Greene

NIH still blaming FOIA delays on the pandemic

New York settles Andrew Cuomo sexual harassment case for nearly $500,000

Americans detained in Venezuela freed and returning home after prisoner exchange

Trump sues Wall Street Journal for libel after Epstein birthday letter story

Trump vows to make US ‘crypto capital of the planet,’ signs GENIUS Act into law

Illegal pleads guilty to impregnating his own daughter at blue state migrant shelter

Watch: Rare ‘Firenado’ Captured on Video as it Cuts a Swath of Destruction

FBI captures final illegal immigrant inmate who escaped ICE facility in New Jersey

Illegal Alien Claimed She Was Illegally Kidnapped by ICE – Then the Surveillance Footage Was Located

Germany admits Europeans were ‘free riders’ on defense and national security

Border Patrol Hits Jackpot in Raid on California Home Depot

Missing mom’s convicted killer claims boyfriend tainted his trial

Source: Bloomberg

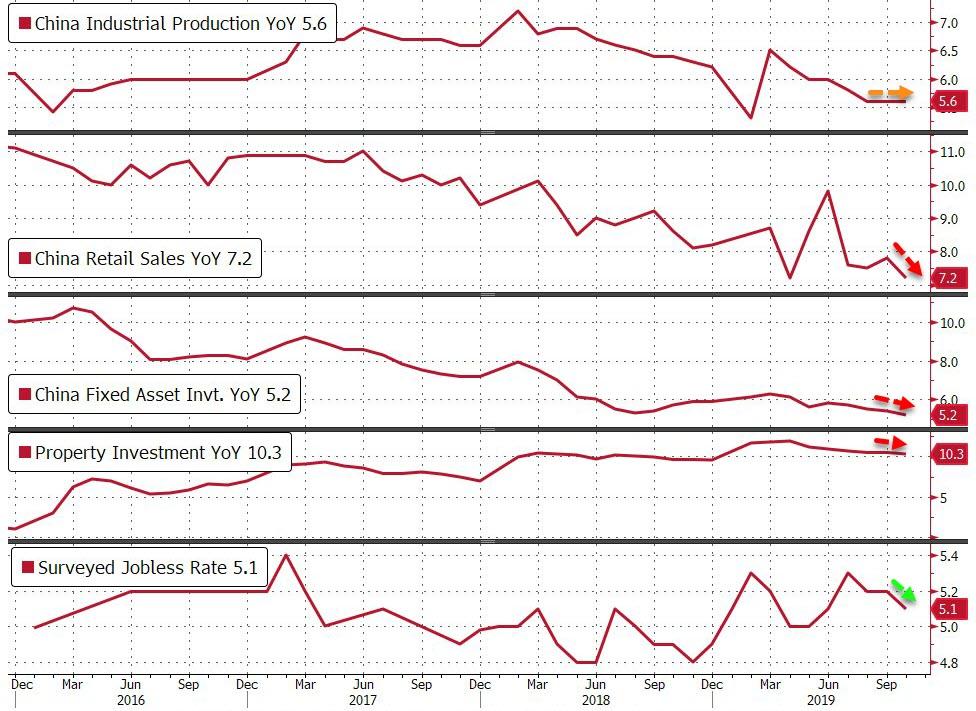

… tonight’s macro data dump from China is expected to show continued slowing from Q3’s disappointing GDP print.

Bloomberg Economics’ Chang Shu notes that the October activity data are likely to show weakness continuing to spread across China’s economy, as companies adjusted to an additional 15% U.S. tariffs on $110 billion of Chinese goods in September.

- China Industrial Production MEET +5.6% YoY vs +5.6% YoY Exp

- China Retail Sales MISS +7.2% YoY vs +7.8% Exp

- China Fixed Asset Investment MISS +5.2% YoY vs +5.4% Exp.

- China Property Investment FELL to +10.3% YoY from +10.5% YoY

- China Surveyed Jobless Rate FELL to 5.1% from 5.2%

Christian university rebranding DEI to evade Trump order, enroll illegals, Tennessee rep says

Mike Huckabee Threatens to Declare Israel ‘No Longer Welcoming’ to Christian Organizations After ‘Shocking’ Policy Change

Former Voice of America Staffer Charged Over Alleged Death Threats Against Marjorie Taylor Greene

NIH still blaming FOIA delays on the pandemic

New York settles Andrew Cuomo sexual harassment case for nearly $500,000

Americans detained in Venezuela freed and returning home after prisoner exchange

Trump sues Wall Street Journal for libel after Epstein birthday letter story

Trump vows to make US ‘crypto capital of the planet,’ signs GENIUS Act into law

Illegal pleads guilty to impregnating his own daughter at blue state migrant shelter

Watch: Rare ‘Firenado’ Captured on Video as it Cuts a Swath of Destruction

FBI captures final illegal immigrant inmate who escaped ICE facility in New Jersey

Illegal Alien Claimed She Was Illegally Kidnapped by ICE – Then the Surveillance Footage Was Located

Germany admits Europeans were ‘free riders’ on defense and national security

Border Patrol Hits Jackpot in Raid on California Home Depot

Missing mom’s convicted killer claims boyfriend tainted his trial

This is the equal weakest retail sales growth since 2003 and weakest Fixed-Asset Investment growth since 1998..

Source: Bloomberg

This data confirms that China’s economy slowed further in October, signaling, as Bloomberg’s Miao Han notes, that policy makers’ piecemeal stimulus is failing to boost output and investment amid ongoing trade tensions with the U.S. and subdued domestic demand.

As a reminder, there was the surprising divergence in the two manufacturing PMI readings, with the “official” version weakening, and the Caixin-labeled version strengthening.

Christian university rebranding DEI to evade Trump order, enroll illegals, Tennessee rep says

Mike Huckabee Threatens to Declare Israel ‘No Longer Welcoming’ to Christian Organizations After ‘Shocking’ Policy Change

Former Voice of America Staffer Charged Over Alleged Death Threats Against Marjorie Taylor Greene

NIH still blaming FOIA delays on the pandemic

New York settles Andrew Cuomo sexual harassment case for nearly $500,000

Americans detained in Venezuela freed and returning home after prisoner exchange

Trump sues Wall Street Journal for libel after Epstein birthday letter story

Trump vows to make US ‘crypto capital of the planet,’ signs GENIUS Act into law

Illegal pleads guilty to impregnating his own daughter at blue state migrant shelter

Watch: Rare ‘Firenado’ Captured on Video as it Cuts a Swath of Destruction

FBI captures final illegal immigrant inmate who escaped ICE facility in New Jersey

Illegal Alien Claimed She Was Illegally Kidnapped by ICE – Then the Surveillance Footage Was Located

Germany admits Europeans were ‘free riders’ on defense and national security

Border Patrol Hits Jackpot in Raid on California Home Depot

Missing mom’s convicted killer claims boyfriend tainted his trial

Source: Bloomberg

Dow futures are exuberantly surging overnight as yuan continues to slide – disagreeing vehemently over the chances of a US-China trade deal after their joint celebrations last week…

Source: Bloomberg

Finally, as we just noted, The National Institution for Finance and Development (NIFD) on Wednesday said that China’s economic growth rate will slow to 5.8% in 2020 from an estimated 6.1% this year, a number which is already quite ambitious, not to say artificially goalseeked.

Christian university rebranding DEI to evade Trump order, enroll illegals, Tennessee rep says

Mike Huckabee Threatens to Declare Israel ‘No Longer Welcoming’ to Christian Organizations After ‘Shocking’ Policy Change

Former Voice of America Staffer Charged Over Alleged Death Threats Against Marjorie Taylor Greene

NIH still blaming FOIA delays on the pandemic

New York settles Andrew Cuomo sexual harassment case for nearly $500,000

Americans detained in Venezuela freed and returning home after prisoner exchange

Trump sues Wall Street Journal for libel after Epstein birthday letter story

Trump vows to make US ‘crypto capital of the planet,’ signs GENIUS Act into law

Illegal pleads guilty to impregnating his own daughter at blue state migrant shelter

Watch: Rare ‘Firenado’ Captured on Video as it Cuts a Swath of Destruction

FBI captures final illegal immigrant inmate who escaped ICE facility in New Jersey

Illegal Alien Claimed She Was Illegally Kidnapped by ICE – Then the Surveillance Footage Was Located

Germany admits Europeans were ‘free riders’ on defense and national security

Border Patrol Hits Jackpot in Raid on California Home Depot

Missing mom’s convicted killer claims boyfriend tainted his trial

This, as the SCMP notes, is at the bottom end of China’s target range of 6 to 6.5% growth for 2019, and further indicates the continued downward pressure on the economy from the trade war with the United States as well as domestic headwinds.

“The economic slowdown is already a trend,” said former central bank adviser Li Yang, who heads the institute that is affiliated to the Chinese Academy of Social Sciences (CASS).

“We must resort to deepened supply-side structural reform to change it or smooth the slowdown, rather than solely rely on monetary or fiscal stimulus.”

The institute’s forecast is in line with the International Monetary Fund, and indicates the challenge that policymakers face to achieve the above 6% growth rate needed in 2019 and 2020 to reach the government’s goal of doubling GDP in 2020 compared to its 2010 level.

As a reminder, a GDP growth rate below 6% would be the first time since the aftermath of the 1989 Tiananmen crackdown.

Finally, we note that Navarro and his trade hawks in the White House will be pleased at these weak numbers. President Trump has repeatedly said that China needs a deal more than the U.S. does, and these numbers as leverage in their negotiations.

Story cited here.