One of the worst years for stocks in recent decades came after President Joe Biden made a series of rosy predictions about their performance.

The S&P 500 index has fallen nearly 20% since the beginning of the year, rivaling the 37% decline witnessed in 2008 amid the collapse of the American banking system, as well as the 12% and 22% declines witnessed in 2001 and 2002 amid the dot-com bubble. Persistent inflation, supply chain bottlenecks, and geopolitical pressures rendered 2022 the seventh worst year for stocks since the Great Depression began in 1929. To make matters worse, 2022 is one of the few years on record in which both the stock market and the bond market were negative.

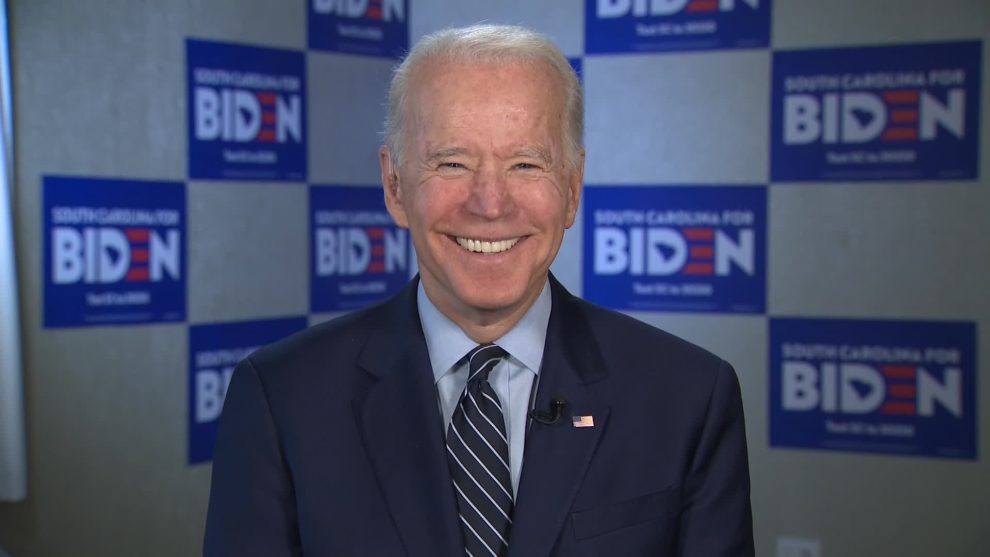

Administration staffers and the commander-in-chief himself nevertheless lauded the stock market’s performance in the weeks before its substantial decline. During remarks about unemployment delivered in the first days of January 2022, Biden noted that the stock market was approximately 20% “higher than it was when my predecessor was there.”

“It has hit record after record after record on my watch, while making things more equitable for working-class people. At the same time, we’ve created jobs, reduced unemployment, raised wages,” Biden said. However, rising price levels would continue to outpace nominal wage increases in the following months, leading to a 1.9% year-over-year decline in earnings by November 2022, according to data from the Bureau of Labor Statistics.

During comments about labor unions delivered in September 2021, the commander-in-chief noted that “the stock market has gone up exponentially” since he ascended to the Oval Office. “You haven’t heard me say a word about it. I’m glad it’s gone up.”

White House Chief of Staff Ron Klain scoffed at a prediction from the “former guy,” an apparent reference to former President Donald Trump, that the stock market would plummet under Biden, contending in November 2021 that Biden “cares about main street, not Wall Street.”

The lackluster stock market, however, has weighed heavily upon households. Americans saving for retirement saw their IRA balances fall year-over-year by an average of 25% in the third quarter, while 401(k) balances dropped 23%, according to research from Fidelity Investments. The proportion of individuals with negative sentiment regarding their finances now surpasses the proportion of individuals with positive feelings, marking a significant reversal since last year.

The average 401(k) account value dropped from $135,000 on the first day of the year to roughly $101,000 by the middle of October, according to a study from the Committee to Unleash Prosperity, offering a dismal view of the past several months under the Biden administration even as stocks have somewhat rebounded in recent weeks.

“This has inflicted considerable financial losses for senior citizens or those in the baby-boom generation who are nearing retirement,” concluded Stephen Moore and E.J. Antoni, the conservative-leaning economists who drafted the study. “For a married couple where each person has the average balance in their retirement account, their $270,000 in savings has declined about $80,000, which can be nearly the equivalent of a down payment on a retirement home. In this way, Biden’s economic policies have not only negatively affected the real take home pay of middle-class American workers but have also effectively stolen tens of thousands of dollars of lifetime savings.”

Story cited here.