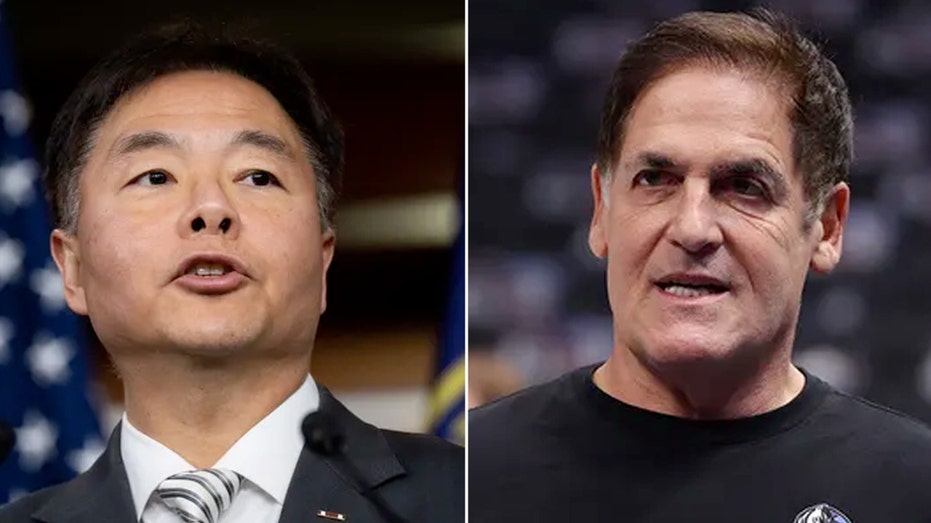

Rep. Ted Lieu, D-Calif., was criticized by billionaire business entrepreneur Mark Cuban after accusing former President Donald Trump of lying about being a billionaire and not being able to secure a $464 million appeal bond.

Trump has not been able to secure the required $464 million appeal bond he needs following a New York civil fraud judgment against him, and his attorneys said in a court filing Monday that obtaining one is a “practical impossibility under the circumstances presented.”

Lieu reposted a story from another media company on the matter yesterday on X.

“Trump claims he is a billionaire. But he can’t pay a $464 million [judgment],” Lieu tweeted. “That means he is lying. How do I know? Math.”

TRUMP UNABLE TO GET $464M APPEAL BOND TO STOP COLLECTION, ATTORNEYS SAY: ‘PRACTICAL IMPOSSIBILITY’

He also tweeted that if bond companies thought the former president had enough assets, they would have provided the bond.

Several people responded to Lieu about his logic, telling him he was wrong, including Cuban.

The entrepreneur told Lieu he was not a supporter of Trump.

“How anyone can vote for someone who has so many of his executive employees turn on him, and say he is incompetent is beyond me,” Cuban wrote. “But you are wrong on this topic Ted.”

Cuban’s post turned into more of a TED talk on the economy.

He told Lieu that net worth was completely different from cash in the bank, adding that the country has been in a zero-interest rate environment for a long time.

NEW YORK ATTORNEY GENERAL TAUNTS TRUMP ABOUT INTEREST HE OWES ON CIVIL FRAUD JUDGMENT

“So, keeping cash in the bank or even money markets was dumb. In fact, searching for yield is what killed small banks last year,” Cuban wrote. “Also dumb was keeping interest rates that low for that long. Something Trump demanded more of.”

Cuban told Lieu he could argue Trump “sucked” at growing his net worth, resulting in him putting himself in the position of lying to banks about his assets. But the only reason to lie on a loan application, Cuban acknowledged, is because you have to.

Cuban continued to talk on a more macro basis, saying even if rates remained on a long-term trend line for the last 10 years, few people keep over 45% of their assets in liquid assets.

“And as far as the bond companies, Trump’s assets are mostly interests in commercial real estate and foreign assets,” he said. “No bond company is loaning against them in this commercial real estate market, if ever.”

TRUMP APPEALS RULING IN MASSIVE NY CIVIL FRAUD CASE

Trump’s filing on Monday said, “ongoing diligent efforts have proven that a bond in the judgment’s full amount is ‘a practical impossibility.’”

The filing also said efforts were made to include approaching about 30 surety companies through 4 separate brokers.

“A bond requirement of this enormous magnitude – effectively requiring cash reserves approaching $1 billion…is unprecedented for a private company,” the filing read.

A New York Appeals Court judge previously ruled that the former president must post a bond for the full amount of the judgment and that an independent director of compliance will be appointed.

That ruling comes after Engoron handed down his decision earlier in February after a months-long trial beginning in October in which the former president was accused of inflating his assets and committing fraud in financial documents.

Engoron ruled that Trump and other defendants were liable for “persistent and repeated fraud,” “falsifying business records,” “issuing false financial statements,” “conspiracy to falsify false financial statements,” “insurance fraud” and “conspiracy to commit insurance fraud.”

Greg Norman of Fox News Digital contributed to this report.