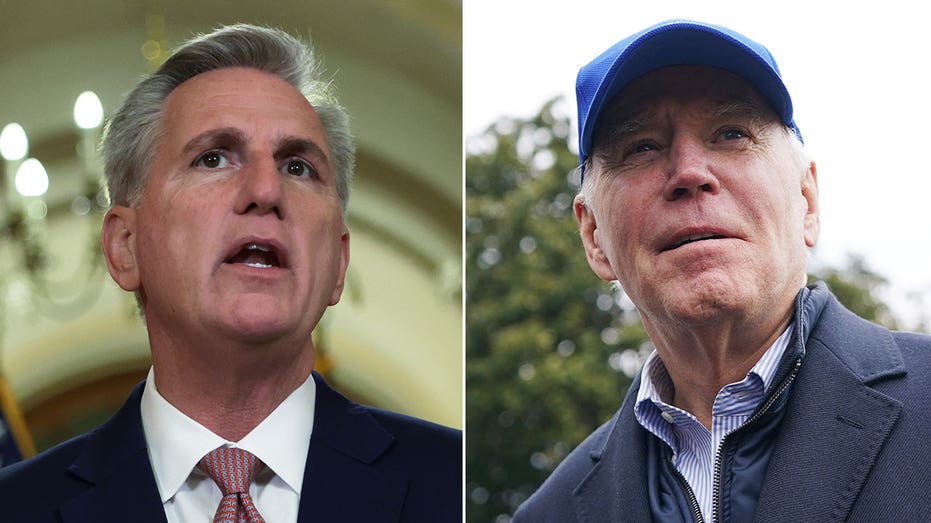

The debt ceiling deal struck by President Joe Biden and House Speaker Kevin McCarthy, R-Calif., passed a critical hurdle Tuesday night that should allow House lawmakers to vote on the agreement Wednesday evening.

The House Rules Committee approved the terms of debate for the legislation by implementing that agreement in an 7-6 vote Tuesday evening. A successful vote wasn’t a sure thing, as three Republican members of the committee had indicated either opposition or possible opposition to the agreement.

Republicans hold a 9-4 advantage in the Rules Committee, which means if three Republicans voted against it along with every Democrat, the bill cementing the Biden-McCarthy deal could not have been considered on the House floor.

But in the final committee vote, only Reps. Ralph Norman, R-S.C., and Chip Roy, R-Texas, voted against it, along with all four Democrats. That allowed it to pass and set up votes on the House floor Wednesday.

DEBT CEILING AGREEMENT IN PRINCIPLE REACHED BETWEEN DEMOCRATS, REPUBLICANS

While the legislation is expected to pass in a bipartisan vote, the two parties used the hearing to blame each other for rushing to raise the government’s borrowing limit just days before it’s expected to run out of money.

Democrats accused Republicans of wanting to “default on America” with the passage of their initial debt limit bill, the Limit, Save, Grow Act, and criticized the tougher work requirements McCarthy’s team negotiated for people who receive federal assistance.

Some Republicans praised the bill, backing McCarthy’s effort to secure some spending cuts, but others argued the bill doesn’t do enough to clamp down on spending.

“This bill is smoke and mirrors,” said Norman. “I get why the Democrats are voting for it … because they get pretty much what they want.”

GOP TOUTS MCCARTHY-BIDEN DEAL AS ‘CONSERVATIVE’ VICTORY AS SOME REPUBLICANS DEFECT

House Ways and Means Committee Chairman Jason Smith, R-Mo., challenged Norman’s assertion in the hearing.

“This bill is clearly not everything that I want by any means, I wanted a lot more. But it’s definitely better than the blank check debt limit that the president was pushing,” Smith said.

Roy called the projected $2 trillion in savings from the bill “a fiction” and cited an estimate that says the bill would add $4 trillion to the national debt.

TOP MCCARTHY DEBT LIMIT NEGOTIATOR SAYS GOP WON’T CAVE ON WORK REQUIREMENTS: ‘HELL NO’

“We ought to do better. The Limit, Save, Grow Act was a responsible approach to actually reduce spending, to change how this town works,” Roy said. “This doesn’t represent any material change in the direction the country is going in terms of spending.”

Rep. Thomas Massie, R-Ky., the third House Freedom Caucus member on the Rules Committee, revealed during the hearing that he would vote in favor of advancing it to the House floor – leaving open whether he would support it there or not.

The final agreement reached over the weekend suspends the debt limit with no cap through Jan. 1, 2025, while also cutting non-defense spending to near fiscal 2022 levels, capping growth at 1% for the next two years and proposing non-mandatory caps for the four years after. It also claws back some money aimed at the Internal Revenue Service and some unspent COVID-19 pandemic funds.

At least 50 amendments have been proposed by lawmakers on both sides of the aisle, but the Rules Committee rejected all of them in a bid to keep the deal the same as what was negotiated between House GOP leaders and the White House.