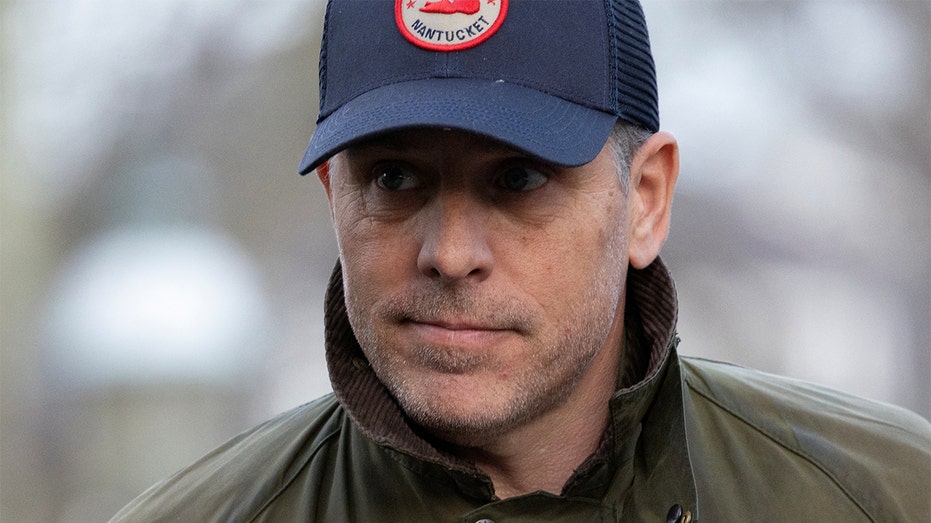

President Biden’s embattled son Hunter Biden is facing a new set of tax-related charges in California.

Hunter Biden is facing nine charges alleging a “four-year scheme” when he did not pay his federal income taxes from January 2017 to October 2020 while also filing false tax reports.

The charges break down to three felonies and six misdemeanors centered around $1.4 million in owed taxes that were since paid.

HUNTER BIDEN FACES NEW INDICTMENT IN CALIFORNIA

Special Counsel David Weiss alleged Hunter “engaged in a four-year scheme to not pay at least $1.4 million in self-assessed federal taxes he owed for tax years 2016 through 2019, from in or about January 2017 through in or about October 15, 2020, and to evade the assessment of taxes for tax year 2018 when he filed false returns in or about February 2020.”

Weiss said that, in “furtherance of that scheme,” the younger Biden “subverted the payroll and tax withholding process of his own company, Owasco, PC by withdrawing millions” from the company “outside of the payroll and tax withholding process that it was designed to perform.”

The special counsel alleged that Hunter “spent millions of dollars on an extravagant lifestyle rather than paying his tax bills,” and that in 2018, he “stopped paying his outstanding and overdue taxes for tax year 2015.”

Weiss alleged that Hunter “willfully failed to pay his 2016, 2017, 2018, and 2019 taxes on time, despite having access to funds to pay some or all of these taxes,” and that he “willfully failed to file his 2017 and 2018 tax returns on time.”

FROM SEX CLUBS TO STRIPPERS: HERE ARE THE 5 MOST SALACIOUS DETAILS FROM THE HUNTER BIDEN INDICTMENT

“[W]hen he did finally file his 2018 returns, included false business deductions in order to evade assessment of taxes to reduce the substantial tax liabilities he faced as of February 2020,” Weiss alleged.

Counts one, two, four and nine allege that Hunter did not pay his taxes in the years 2016, 2017, 2018 and 2019, respectively.

Counts three and five allege that Hunter failed to file his taxes in the years 2017 and 2018, respectively.

Count five of the indictment noted that Hunter raked in a “gross income in excess of $2.1 million” and alleged the presidential scion failed to pay his taxes on his millions of dollars of income.

Count six alleges Hunter’s “evasion of assessment for 2018 Form 1040” regarding his taxes, while count seven alleges Hunter filed “a false and fraudulent 2018 Form 1040.”

The sixth count also alleges Hunter “finally filed his 2018 Form 1040 in 2020 in order to avoid being held in contempt of court in two civil proceedings.”

Additionally, count eight alleges Hunter filed “a false and fraudulent 2018 Form 1120.”

Hunter pleaded not guilty in October to federal gun charges in U.S. District Court for the District of Delaware after being charged out of Weiss’ yearslong investigation.

Thursday’s development comes ahead of an expected vote from House Republican leaders next week on a measure that would formally initiate an impeachment inquiry into President Biden over possible ties to his son’s business dealings.

Hunter’s defense attorney Abbe Lowell attacked Weiss over the Thursday charges, accusing the special counsel of “bowing to Republican pressure” when talking to the press.

“Based on the facts and the law, if Hunter’s last name was anything other than Biden, the charges in Delaware, and now California, would not have been brought,” Lowell said in a statement.

Fox News Digital’s Bradford Betz, Jake Gibson, David Spuntz and The Associated Press contributed reporting.