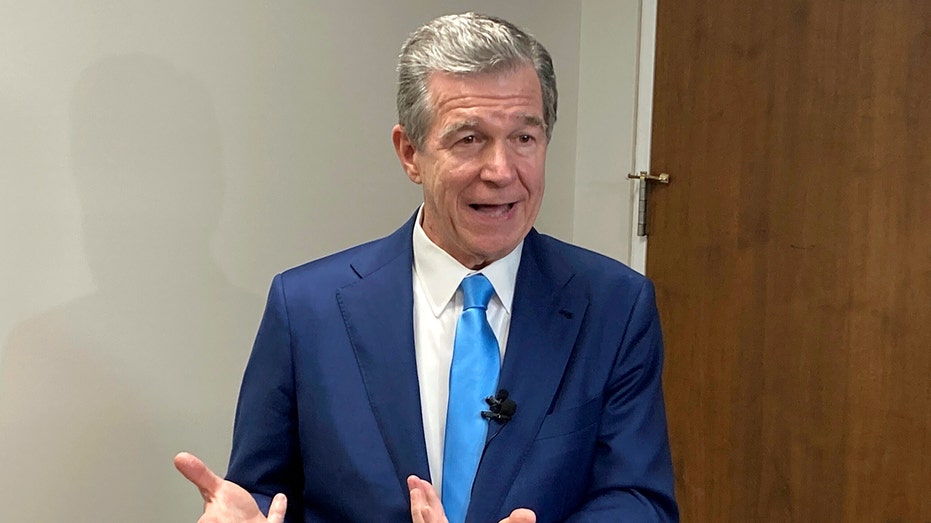

North Carolina Democratic Gov. Roy Cooper said on Tuesday he’s skeptical that an apparent tax agreement by Republican legislative leaders within a state budget that’s still being negotiated would over time protect revenues to fund pressing needs within government.

House Speaker Tim Moore and Senate leader Phil Berger provided on Monday few details about the tax deal they said has been reached, except that it would reduce the individual income tax rate beyond a downward trajectory of 3.99% in 2027 that’s already in state law. And they said deeper rate cuts couldn’t happen unless the state’s coffers first reach certain revenue levels, as a bulwark against fiscal shortfalls.

Cooper has opposed repeatedly across-the-board individual and corporate tax cuts already enacted by Republicans because he believes they unfairly benefit the wealthy. Speaking to reporters following a monthly meeting of 10 statewide elected officials called the Council of State, Cooper suggested those proposed revenue “triggers” may be ineffective.

“What I hope is that they have come up with a tax plan that would make it difficult … to give those tax breaks for the wealthiest and corporations,” Cooper said. “But I have my doubts about that.”

NORTH CAROLINA REPUBLICANS CLOSING IN ON STATE BUDGET THAT WILL LOWER INCOME TAX RATES

His own budget proposal this year would have blocked upcoming tax reductions already on the books for the highest wage earners and corporations, but Republican ignored the idea. The 2.5% corporate income tax rate is already on track to fall to zero in 2030. Cooper has said additional tax cuts will threaten the state’s ability to fund public education adequately in the years ahead.

Lawmakers had aimed to get a two-year state budget in place before the current fiscal year started July 1, but negotiations slowed over taxes and how to distribute billions of dollars for reserves. Final budget votes could happen in mid-August. Cooper could veto the measure, but Republicans have veto-proof majorities in both chambers and could complete an override.

A requirement in the Medicaid expansion law that Cooper signed in March that says a state budget law must be enacted before expansion can be implemented may force the governor to swallow policy provisions in the budget that he’s uncertain about or dislikes.

Those provisions could include a large expansion of taxpayer-funded scholarships for K-12 student to attend private schools, which he strongly opposes. And lawmakers are talking about authorizing up to four casinos — an idea that Cooper said has many unanswered questions.

More gambling “is a significant issue and one that requires scrutiny and public input” and should be run separately from the budget, Cooper said.

Council members who run standalone state agencies and are awaiting a final budget to learn how many more positions they’ll have to fill. They include Secretary of State Elaine Marshall, a Democrat at the job since 1997, who runs an office that registers corporations, oversees legislative lobbyists, commissions notaries and investigates securities fraud.

During the council meeting, Marshall pleaded for legislators to give her department more resources to handle a soaring workload. Since the coronavirus pandemic began, Marshall said, her agency has had to respond to a 70% increase in new business creations. The department has an annual budget of $18 million and fewer than 200 employees, she said.

“We are on the brink of a crisis,” Marshall said. “We continue to communicate with the General Assembly leadership that they must provide additional staff positions to keep up with this beneficial but torrid business filing pace.”

Republican council members — Labor Commissioner Josh Dobson and Agriculture Commissioner Steve Troxler among them — have also in recent months urged legislators to provide more funding to raise salaries and reduce high job vacancy rates.