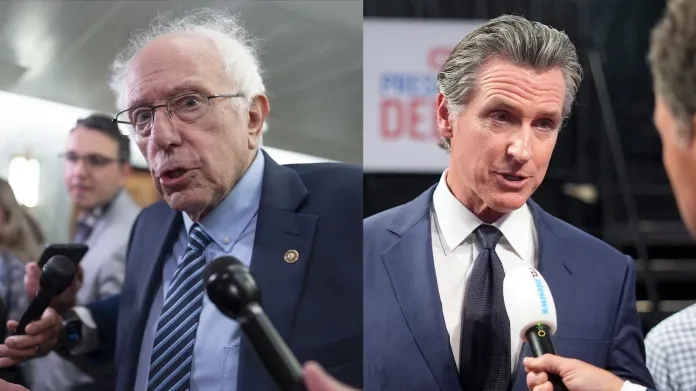

The high-stakes showdown over a proposed wealth tax is intensifying in California, pitting progressive firebrand Sen. Bernie Sanders (I-VT) and a healthcare union against Gov. Gavin Newsom (D-CA) and a coalition of business titans and cryptocurrency executives.

Sanders is set to rally supporters in downtown Los Angeles on Wednesday afternoon, casting the “billionaire tax” as a basic question of economic fairness and urging voters to make billionaires pay more. The Vermont senator, a democratic socialist, is extremely popular in the state and has drawn thousands of people out before. Though he’s a millionaire himself, he has been fighting against the wealth gap for decades.

Opponents of the tax are mounting an aggressive counteroffensive, launching ad campaigns, raising millions of dollars, and advancing competing ballot measures.

The proposal, which faces formidable political and legal obstacles, calls for California residents with more than $1 billion in assets to pay a one-time tax equal to 5% of their total assets. For example, someone with $1 billion in assets would be required to pay $50 million in taxes over five years.

Advocates argue that a tax on billionaires is necessary to address affordability, that the state’s economic identity isn’t easily shaken, and that most of its 216 billionaires won’t leave.

Supporters also emphasize that the tax will be structured to address fairness concerns. Billionaires concerned about asset valuations can submit independent third-party appraisals. If paying the full 5% at once is difficult, the law would allow payments to be spread over five years, with interest applied. For those whose wealth is held in illiquid assets, such as private start-ups, the tax can be deferred rather than forcing a sale.

Those against it, including Newsom, claim the tax will hurt California in the long run and choke off innovation. The outgoing governor, who is considering a 2028 presidential run, has already threatened to use whatever political capital he has left to block it.

The healthcare workers’ union faces an April deadline to gather nearly 900,000 valid signatures to qualify the tax measure for the November ballot. Union leaders are counting on Sanders’s visit to galvanize supporters, as the campaign has already trained more than 1,000 volunteers and increased the per-signature pay for petition circulators to accelerate the push.

Sanders is seen as a powerful draw for the union. He captured more than a third of the vote in California’s 2020 Democratic presidential primary and maintains a strong populist following in the state. His appearance comes just two days ahead of the California Democratic Party’s convention in San Francisco, where organizers hope to harness the energy around him to build additional momentum behind the measure. Newsom is expected to skip the event.

The state has already seen an exodus of billionaires who say California’s taxes have gone too far and that they have no problem spending their money elsewhere. At least six have already left, packing up their fortunes and relocating to low-tax havens such as Texas and Florida.

High-profile names such as venture capitalist and GOP mega-donor Peter Thiel, as well as Google co-founders Larry Page and Sergey Brin — the world’s second- and third-richest men, respectively — have taken steps to cut ties with California. Page, 52, has moved many of his business interests out of the state, including his family office. He recently paid $173.4 million for two homes in Florida.

DEBATE HEATS UP OVER CALIFORNIA WEALTH TAX

Last week, Facebook founder Mark Zuckerberg and his wife, Priscilla Chan, were among the latest billionaires to buy a home in South Florida. The couple has a home in Palo Alto, California, the cradle of Silicon Valley.

Emails to Newsom’s office seeking comments on Sanders’s visit went unanswered.