Americans are already coping with the hottest inflation in four decades, and Russia’s full-scale attack on Ukraine could push it even higher.

The conflict roiled the global market Thursday, pushing oil prices above $105 for the first time since 2014 and raising concerns of a prolonged inflation surge after Russia launched a broad offensive, hitting Ukrainian cities and bases with airstrikes and shelling.

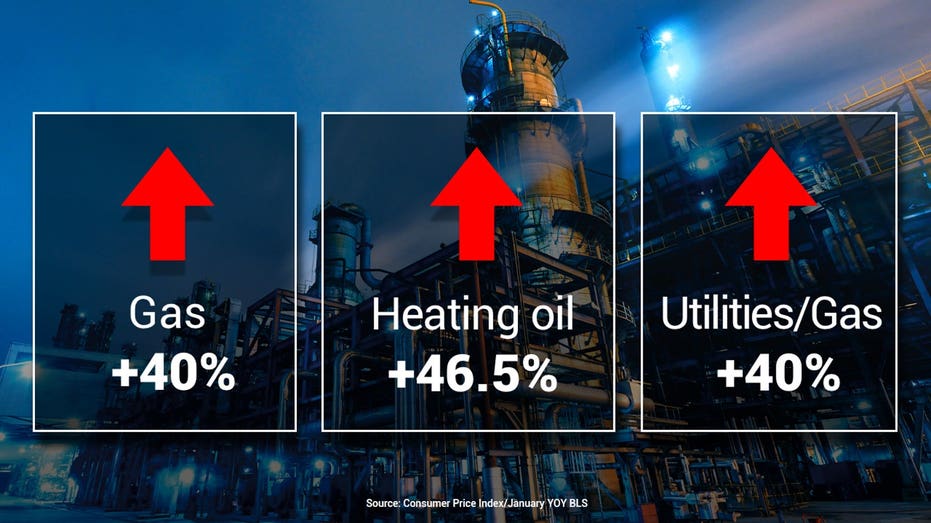

The consumer price index rose 7.5% in January, the fastest since 1982, in large part because of a spike in energy prices. Energy prices have climbed 27% over the past year, in part due to lopsided supply and demand. Consumers are traveling more, but the supply side has not kept up with the demand.

Experts have warned that inflation and energy prices could get even worse as the crisis in Ukraine escalates.

The war in Europe, which has shattered nearly three decades of peace on the continent, could ultimately cause oil prices to surge as much as 20% to $120 a barrel, according to one estimate from RSM Chief Economist Joe Brusuelas. He suggested inflation could surge as much as 10% on a year-over-year basis in the U.S. if that happened.

U.S. consumers are already facing sticker shock at the pump. A gallon of gas, on average, cost $3.51 nationwide on Tuesday, according to AAA – up from $2.63 a year ago. In California, gas prices are well over $4 per gallon.

Russia is the world’s second-largest producer of both oil and natural gas; a conflict or sanctions could disrupt the oil market even further at a time when high demand is outpacing tight supplies. OPEC and other oil-producing nations, together known as OPEC+, have resisted calls to boost supply.

Germany already halted the certification of the Nord Stream 2 gas pipeline from Russia, while the U.S. and the European Union have also levied harsh financial sanctions against Moscow after it launched a wide-ranging attack on Ukraine that threatens to upend the geopolitical order and reverberate throughout the rest of the world.

JPMorgan Chase economists have warned that any disruption to Russia’s supplies could “easily” send oil to $120 a barrel.

In a bid to reduce prices at the pump, President Biden on Thursday suggested the U.S. and its allies release oil from a global petroleum reserve in coming days.

The U.S. is expected to release between 30 million and 35 million barrels, which would be carried out over time, according to Politico, citing a person familiar with the matter. The administration is trying to coordinate the release with foreign governments, including those in China and Japan.

“We are actively working with countries around the world to elevate collective release from the strategic petroleum reserves of major energy-consuming countries,” Biden said in remarks from the White House. “The United States will release additional barrels of oil as conditions warrant.”

Russian President Vladimir Putin threatened that any foreign country attempting to interfere will be hit with “consequences you have never seen,” an apparent reference to Moscow’s nuclear arsenal. American and European officials also fear that Russia may retaliate against the sanctions by cutting off the supply of oil and natural gas that flows from Moscow to Europe, sending prices spiraling higher.

Ukrainian President Volodymyr Zelenskyy cut diplomatic ties with Russia and declared martial law.

“As of today, our countries are on different sides of world history,” Zelenskyy tweeted. “Russia has embarked on a path of evil, but Ukraine is defending itself and won’t give up its freedom.”

Although the invasion sparked fresh jitters about the possibility of a new world war, the U.S. and its NATO allies have so far shown no indication that they would join the war against Russia.

Story cited here.