Tariffs do exactly one thing: raise prices.

Right now, prices don’t need any help getting higher.

Economic data released Friday by the Bureau of Labor Statistics show that year-over-year inflation hit 6.8 percent in November—the highest level recorded since 1982. Despite other indicators showing that the economy is strong, persistently high inflation is a serious problem for American households. That includes the current resident of the White House, for whom inflation is becoming a major political headache.

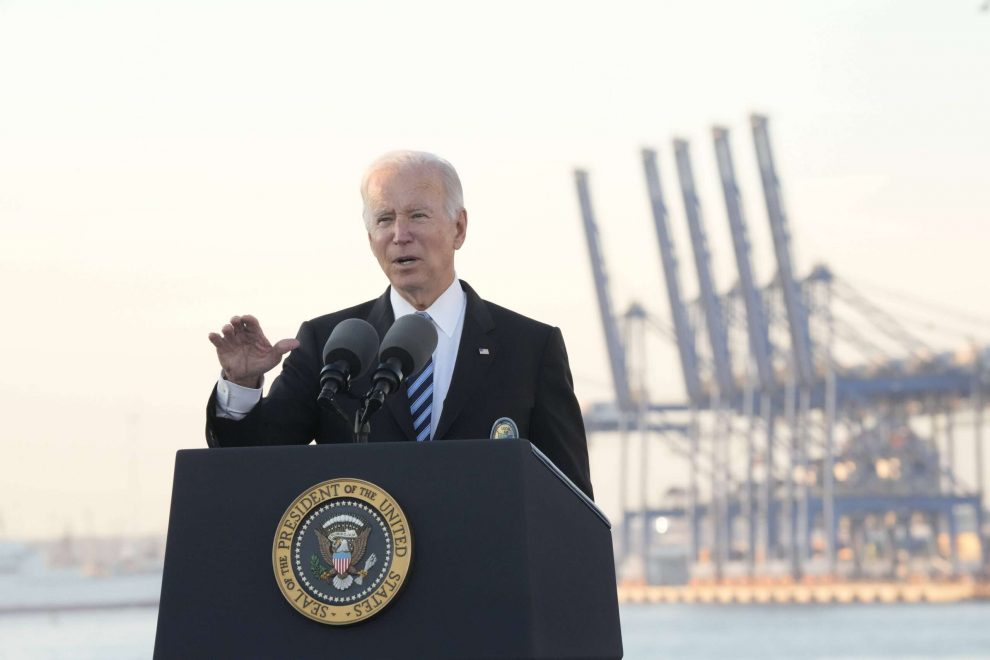

There’s probably not much President Joe Biden can do to curb inflation in the short term. That ship sailed when he pushed for and signed off on a major economic stimulus bill earlier this year—one that economists warned was too large and could overheat the economy. Other factors influencing inflation, like the disconnect between supply and demand that’s largely a result of the ongoing COVID-19 pandemic, are well beyond Biden’s (or any president’s) power to change.

But there is one thing Biden could do to immediately provide consumers with relief. He could eliminate the tariffs imposed by former President Donald Trump.

Those tariffs, which Biden has been stubbornly unwilling to reverse during his first year in office, are adding roughly 0.5 percent to annual inflation across the economy. That’s the conclusion drawn by Ed Gresser, a former assistant U.S. Trade Representative who is currently the vice president and director for trade and global markets at the Progressive Policy Institute, a center-left think tank. Trump’s tariffs on washing machines, solar panels, steel, aluminum, and a host of Chinese-made goods are a “secondary but noticeable contribution” to overall inflation right now, Gresser writes.

That’s pretty much in line with what four economists at the San Francisco Federal Reserve warned in February 2019, shortly after Trump began slapping tariffs on various goods. “Imports from China are an important part of overall U.S. imports of consumer and investment goods,” they wrote. “Thus, tariffs on these imports are likely to have sizable effects on consumer, producer, and investment prices in this country.”

Unlike other policies that could help slow inflation, like raising interest rates, Biden could cut tariffs without having to wait for Congress or the Federal Reserve to act. Similarly, cutting tariffs would not come with some of the negative tradeoffs that other actions might. Raising interest rates will harm the economy in other ways (for example, by making it more expensive to borrow). Lifting tariffs will ease inflation and provide a tax cut to many American businesses. It is quite literally a win-win.

Again: The one and only thing that tariffs do is raise prices. That is their only function. Politicians might want to deploy tariffs (to raise prices) for a number of reasons: to protect domestic industries, to influence where in the world individuals choose to invest, to retaliate against what they perceive as unfair trade practices from other countries, and so on. But all those goals—and tariffs are poor ways of accomplishing most of them—are second-order functions. To the extent that any of those things occur, they happen because tariffs raise prices.

If Biden is going to keep ignoring this basic bit of economic reality, then he is choosing to make inflation worse than it already is.

Story cited here.