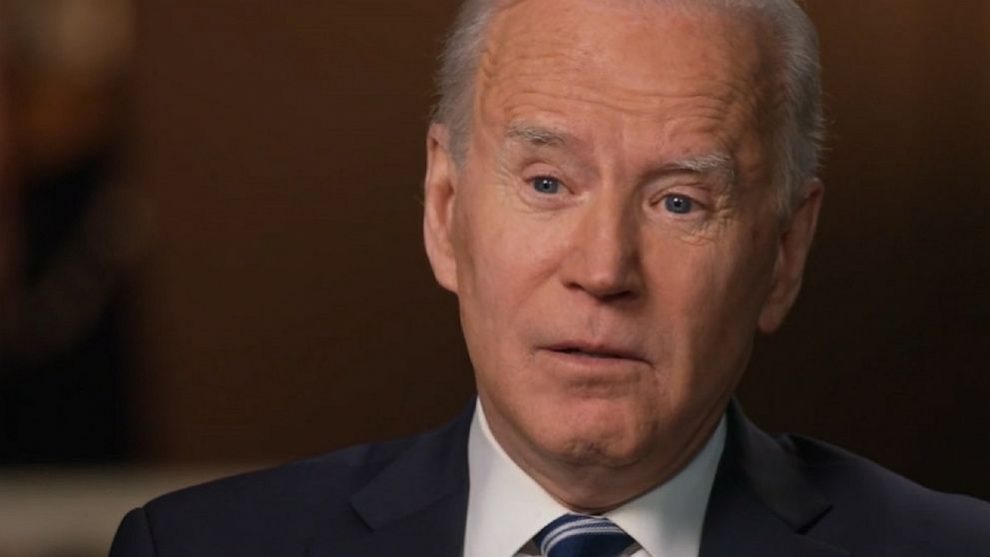

Politicians betray their campaign promises all the time. So, it’s no surprise to see President Joe Biden go back on his word that, in spite of his plan to significantly hike taxes to pay for a portion of a massive increase in spending, nobody earning less than $400,000 annually would suffer a tax increase. But this flip-flop is just the tip of the iceberg.

During the presidential campaign, then-candidate Biden declared that if someone makes less than $400,000, they wouldn’t face any tax hikes. His campaign website reinforced this promise: “Joe Biden will not raise taxes on anyone making less than $400,000. Period.” The president recently reiterated his promise on “Good Morning America” when he said, “Anybody making more than $400,000 will see a small to a significant tax increase,” and “You make less than $400,000, you won’t see one single penny in additional federal tax.”

But then his press secretary, Jen Psaki, announced during a press conference that the threshold of $400,000 refers to family income. She contradicted herself a few days later, saying, “The president remains committed to his pledge from the campaign that nobody making under $400,000 a year will have their taxes increased.”

Either the administration still isn’t fully clear on where it stands, or some taxpayers may be in for a big surprise—or both.

Either way, the sad truth is that with this president’s insane propensity for unconstrained government spending, he shouldn’t make such a promise in the first place. He has already added $1.9 trillion to the enormously inflated federal credit card and is planning on throwing another almost $4 trillion on it in what he deems infrastructure spending. If he sticks to his campaign promises, Biden plans to splurge $11 trillion in additional spending over a decade. Meanwhile, his proposed tax hikes are estimated to reap $2.1 to $2.8 trillion. In other words, for every $5 or $6 in new spending, $1 will be paid for in new taxes, and the rest goes on the nation’s credit card.

I know that’s what politicians do, but that’s still not right. If he wants to raise spending to that level, everyone should pay some price for this growth in government, not simply those earning more than $400,000. That criticism applies to every president before him and will, I’m sure, to many after him.

It’s time for the Democrats who elect presidents that promise not to jack up taxes on anybody but the rich to come to terms with something: These politicians can’t continue to spend that much money without raising taxes on nearly everyone, and that includes some regressive taxes. I don’t like it, since I’d prefer the size and scope of government to be significantly smaller—but this reality is not optional.

Here’s another reason why Biden was never going to be able to keep his promise: He already announced his intention to increase the corporate income tax from the current 21 percent to 28 percent. The reality here is that the corporations that he says are going to send bigger checks to the Internal Revenue Service (IRS) after the tax hike aren’t the ones who actually shoulder this heavier tax burden.

The best explanation I’ve seen on this comes from a 2004 quote by economist Stephen Entin, who wrote, “The economic burden of a tax frequently does not rest with the person or business who has the statutory liability for paying the tax to the government.” That’s because taxes are ultimately only paid by people.

In this case, the burden of Biden’s corporate tax-rate hike will inevitably fall on corporations’ workers and shareholders (which includes almost everyone with a retirement plan), many of whom earn much less than $400,000 a year. Workers might not personally be sending more or bigger checks to the IRS, but they will still suffer higher taxation in the form of lower wages, as well as higher prices for consumer goods and services.

Economists aren’t sure how much of the hike will fall on workers. Estimates range from 66 percent to 100 percent of the tax falling on workers in the form of lower wages. The bottom line is that nobody can determine who truly bears the burden of a tax just by looking at where or on whom it is formally imposed, despite what the tax is called. But one thing is sure: Biden’s promise not to raise taxes on individuals making less than $400,000 is bunk.

Story cited here.